Stocks

After initially ignoring the threat of COVID-19, U.S. equity markets posted one of the worst quarters in history. For the S&P 500 it was the worst quarter since the fourth quarter of 2008. For the Dow Jones Industrial Average, it was the worst first quarter in the index’s 135-year history. The decline was sharp and produced the second fastest bear market in history. Only the Crash of 1987 produced a more rapid bear market.

When we invest in equity markets, we do so with the understanding that bear markets will occur, they will be painful, many times they will come out of nowhere, but over the long-term we are rewarded for this risk with greater returns than bonds. Per Ned Davis Research, since 1901 the Dow Jones Industrial Average has had 37 bear markets. On average that is a bear market every 3.2 years. NDR defines a bear market as a 30% drop in the Dow Jones Industrial Average after 50 calendar days or a 13% decline after 145 calendar days. The chart below illustrates declines in the S&P 500 since 1987. So far, the decline has not been as severe as the financial crisis, when the Dot.com bubble burst, or if we go back further, the bear market in 1973-1974.

The number one question I get is, “Have we seen a bottom?” The number two question I get is, “How long do you think it will take to get back?” The honest answer has to be, “I don’t know.” Ultimately, it will depend on how long it takes to get COVID-19 under control. In my last commentary I stated that recovery would depend on three inter-linked factors:

- The length of time until social distancing ends.

- The effectiveness of fiscal stimulus to stimulate/maintain demand and thus limit the depth of the recession.

- The amount of damage done to corporate balance sheets.

This event is completely unique and not driven by the usual economic factors. We are in a government mandated recession. This has never happened. In our recent partner meeting, our consensus view was that, assuming that we flatten the curve, certain parts of the country will begin to pick up in six to eight weeks. This will slow the recession. Then, our more metropolitan areas will slowly come back. This will put a floor on the economy and start a slight upturn. But it will take time for everyone to get back to business as usual, likely in the later parts of the third quarter.

We believe that, at the lows, the equity markets priced this in. We are carefully watching to see if the S&P 500 tests and holds around the 2200 level. For the short-term, we expect equity markets to become range bound between 2630 and 2200, while we wait to get a better indication of how long social distancing and stay at home orders will remain in place.

Bonds

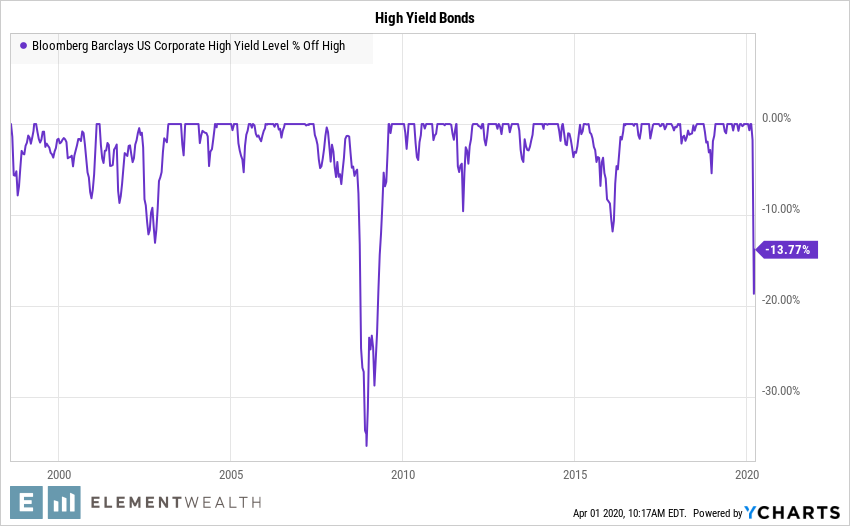

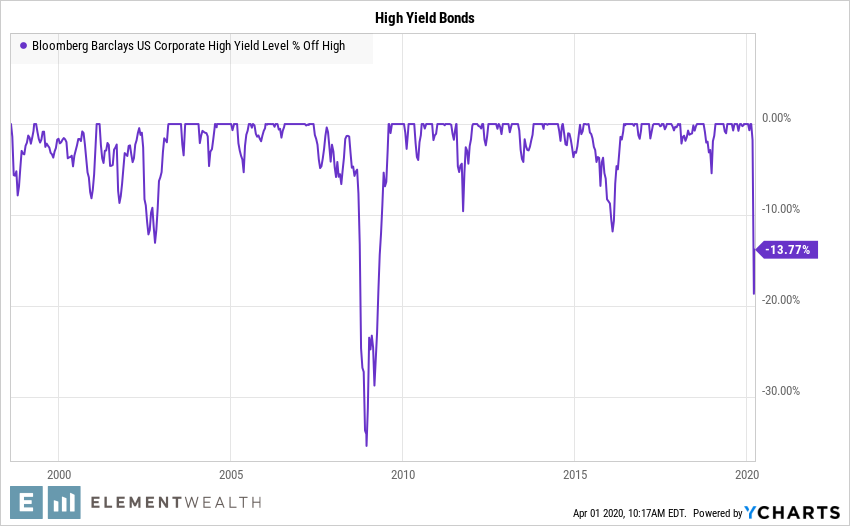

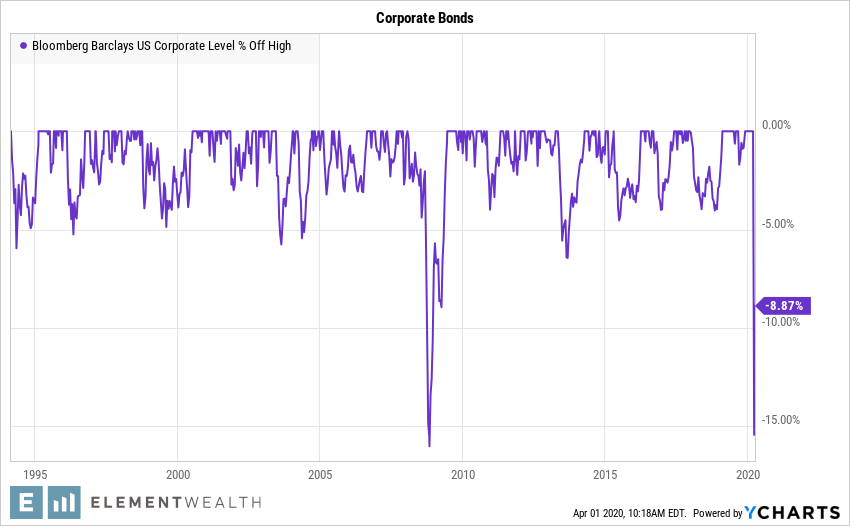

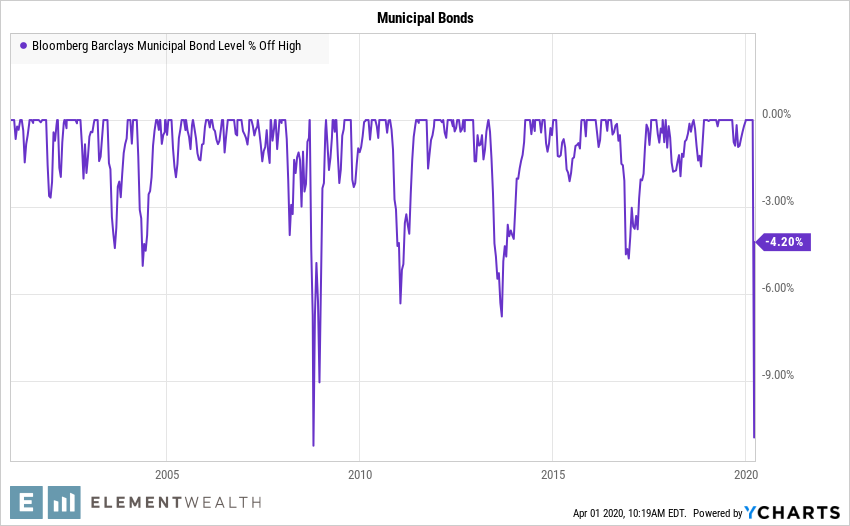

Stocks are viewed as risky; therefore, as we get older and closer to retirement, we begin to diversify into bonds. Unfortunately, the bond markets produced the biggest surprise in the first quarter. A MASSIVE LIQUIDATION and deleveraging in the financial markets sent bonds into a free fall. Liquidity in the bond markets dried up, forcing the Federal Reserve to purchase municipal and corporate bonds in addition to treasury and agency bonds. The three charts below illustrate the declines in high yield bonds, corporate bonds, and municipal bonds.

When equity markets decline, we expect high yield bonds to decline. The worst bear markets in stocks are generally associated with recessions. Recessions hurt corporate earnings and force bankruptcies for companies with weak credit ratings. That’s why we get higher interest rates for high yield, or below investment grade, bonds. Fortunately, recovery times for high yield bonds as an asset class are quicker than stocks. During the financial crisis, the decline in high yield bonds started in mid-May 2008. Investors were back to whole by August 2009. Including dividends, it took the S&P 500 until April 2012 to get back. Thus far, the decline in high yield bonds has not been as severe as during the financial crisis.

What we don’t expect when equity markets decline, is for investment grade corporate and municipal bonds to get crushed. Generally, rising interest rates hurt high quality bonds more than declines in the equity markets. But not in 2020. The lack of liquidity in the bond markets sent investments grade corporate and municipal bonds down nearly as much as during the financial crisis. These markets have sprung back but still have some room to go.

Final Thoughts

It was an alarming first quarter to say the least and we are not finished with COVID-19. But the market knows this and is pricing it in. The best thing to do right now is be patient and remain diversified. We will get through this, just as we got through the financial crisis, Dot.com bubble bust, Crash of 1987 and every other crisis we’ve ever seen. For now, we must be diversified and patient. We expect bonds to continue to recover while stocks remain range bound. Ultimately, opportunity is being created for those who are patient and willing to think beyond the next quarter.

On behalf of everyone at Element Wealth, we wish you well, hope you stay safe and look forward to seeing you as soon as possible.

Jeremy Nelson, Partner

Element Wealth, LLC (EW) is an investment adviser registered with the Securities and Exchange Commission (SEC). EW only transacts business in states where it is registered, or where an exemption from registration is available. Registration as an investment adviser does not constitute an endorsement of the firm by the SEC, nor does it indicate a particular level of skill or ability. Past performance is not indicative of future results, and investors should realize that investing in securities involves risk of loss. Money invested in securities is not guaranteed against such loss by any governmental or non-governmental organization. EW is not a law or accounting firm, and does not give legal, accounting or tax advice.